The stock market is proving surprisingly resilient despite concerns over inflation, tech earnings, and trade tensions.

1. Inflation Heats Up, Markets Stay Cool

- Consumer prices rose 3% in January, the highest annual rate since June last year.

- U.S. stocks initially tumbled Wednesday but rebounded, with the S&P 500 closing just 0.3% lower, staying above the 6,000 level.

2. Federal Reserve’s Stance

- Jerome Powell downplayed the inflation spike, saying the Fed is “close but not there” on controlling inflation.

- He warned against overreacting to one or two bad inflation readings.

- However, some seasonal factors—like minimum wage hikes—may have influenced the data.

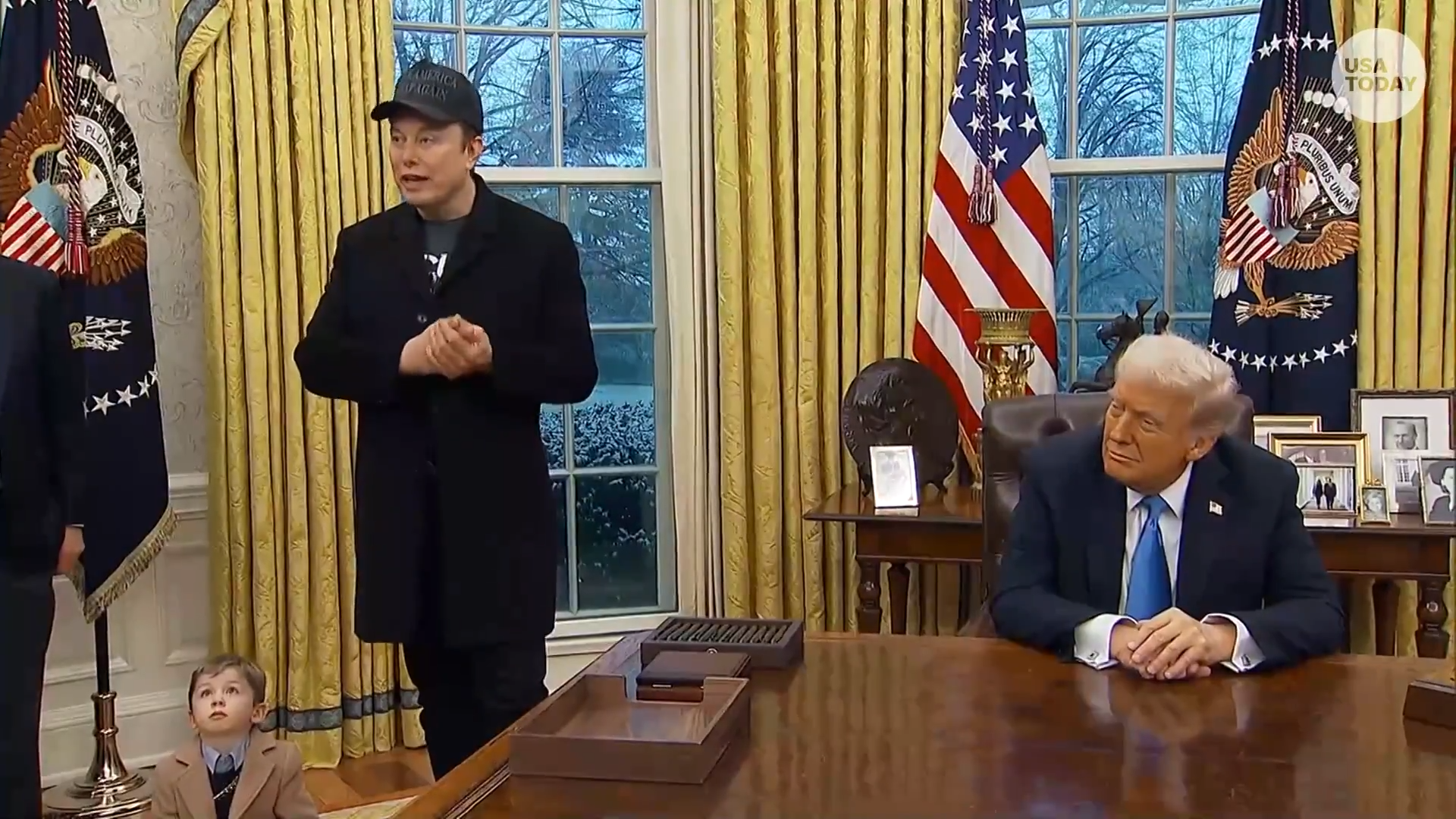

3. The Impact of Trump’s Tariffs

- President Donald Trump’s tariffs could drive inflation higher, making it harder for the Fed to cut rates.

- Despite Trump’s push for lower interest rates, inflation concerns may prevent any significant Fed action.

4. Market Outlook on Rate Cuts

- Traders now expect only one rate cut in 2025, down from two last week.

- The probability of a rate cut by June has dropped to 31% from 46% a week ago.

- If inflation continues rising or the trade war escalates, the Fed may not cut rates at all this year.

5. DeepSeek AI and the Tech Sector’s Struggles

- The emergence of Chinese AI startup DeepSeek has spooked some investors.

- However, broader concerns over tech earnings are contributing to market volatility.

6. What’s Next for Investors?

- Markets are adjusting to uncertainty but remain relatively stable.

- Investors should watch inflation trends, Fed decisions, and tech sector performance for future market moves.