BULL STOCK – STOCK MARKET CYCLES

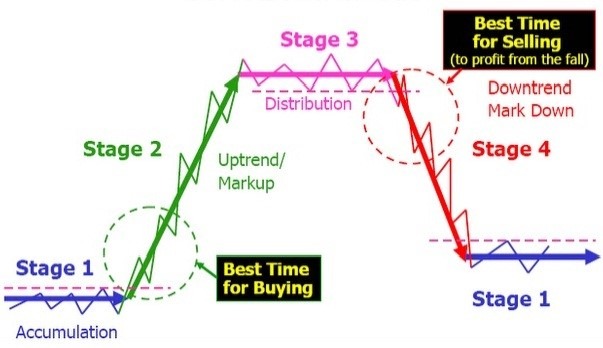

The stock market cycle is generally divided into four main stages. Understanding these stages can help investors make informed decisions about buying and selling stocks. Here’s an overview of each stage:

- Accumulation Phase:

- Description: This phase occurs after the market has bottomed out and sentiment is at its lowest. Pessimism is widespread, and many investors have sold their holdings at a loss.

- Characteristics: Prices stabilize and may begin to rise slowly. Smart money, including institutional investors and insiders, start buying stocks at low prices, recognizing value where others see risk.

- Investor Sentiment: Pessimistic to neutral.

- Markup Phase:

- Description: Following the accumulation phase, the market begins to rise as more investors notice the recovery.

- Characteristics: Increased trading volumes, rising prices, and growing optimism. Economic indicators often start to improve, and companies report better earnings. Media coverage becomes more positive.

- Investor Sentiment: Increasingly optimistic. More investors gain confidence and start entering the market.

- Distribution Phase:

- Description: This phase occurs after the market has risen significantly and reaches a peak. The early investors start to sell their shares to lock in profits.

- Characteristics: Prices may still rise, but at a slower pace. Trading volumes remain high as more participants enter the market. This phase often includes sharp corrections or increased volatility as the market experiences resistance to further upward movement.

- Investor Sentiment: Optimistic to exuberant, but early signs of caution and divergence in sentiment may appear.

- Downtrend Phase (or Bear Market Phase):

- Description: After the distribution phase, the market starts to decline. This phase can be triggered by economic downturns, poor corporate earnings, geopolitical issues, or other negative factors.

- Characteristics: Prices fall, trading volumes may increase as panic selling ensues, and investor sentiment turns negative. This phase can vary in length and severity, with potential rallies that are often short-lived.

- Investor Sentiment: Pessimistic. Fear and panic selling dominate as investors try to cut losses.

Understanding these stages helps investors recognize where the market might be in its cycle and plan their investment strategies accordingly. However, predicting the exact timing of these phases is challenging, and it’s crucial to consider broader economic conditions, company fundamentals, and other factors in making investment decisions.