How to Trade During Events

Markets are known to create randomness during events where all technical, fundamental, and indicator-based analyses are tossed in the air. If you know that techno-funda doesn’t work these times, you might wonder why you should trade at all.

This article will brief you on what you should and shouldn’t do while placing your bets during events.

Do’s:

- Trade in Events: Contrary to popular advice, trading during events can be beneficial. However, caution is key: only bet an amount you are ready to lose, ideally 2-3% of your capital, preferably from your profits. This percentage can be adjusted based on individual capital size and risk appetite.

- Leverage Volatility: Entering the market during vulnerable times can be lucrative. If the probability is on your side, you might cover months of sluggish performance with a small portion of capital that you are willing to risk.

- Experience the Event: Engage with the event to fully understand market dynamics. This hands-on experience will provide you with valuable insights and a taste of the market’s volatility.

- Stay Informed: Be aware of the current events and their implications. For example, during election phases, market reactions can be significant. Common sense and a critical analysis of data, such as exit polls, can provide strategic trading opportunities.

Example: During the election phase on 3rd June, after the exit polls, Nifty rose significantly by 800 points from the previous low. However, the upside potential was limited, and the downside potential was higher, resulting in a significant fall of over 1800 points on the event day.

5. Think Before You Act: Planning your trades carefully before acting can lead to better outcomes. It’s not just about making money on these days but gaining confidence and experience from your bets.

Figure: Nifty rising almost 800 points after exit poll outcome on 3rd June and falling 1800+ points on the event.

Don’ts:

- Don’t YOLO: Never bet your entire capital on a single event with the hope of becoming a millionaire overnight. This approach is extremely risky and should be strictly avoided.

- Plan Exit Strategies: It’s easy to get caught up in the moment, but it’s crucial to have a plan for when to cut your trade, whether in profit or loss. Plan your exits before entering the trade.

- Avoid Full Capital Deployment: Deploying your entire capital during events is suicidal. When things go wrong, stop losses can be jumped, margin calls can be triggered, and panic can ensue.

Bonus Tips:

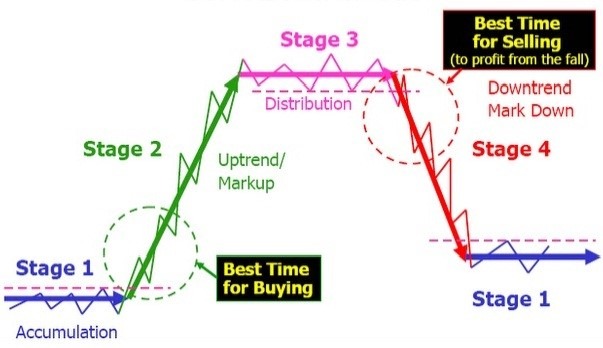

- Sell On or After the Event: It’s often safer to sell on or after the event when the market has digested the news and the initial volatility has settled.

- Cap Downside Risk: Always cap your downside risk to protect your capital from significant losses.

By following these guidelines, you can navigate the chaotic waters of market events more effectively, balancing the potential for profit with risk management strategies.

Disclaimer: This is just a recommendation. Do your due diligence before any bets.