Long-Term Vs Short-Term Investment

Investing in stocks can be approached with either a long-term or short-term perspective, each with its own advantages and disadvantages. Understanding the pros and cons of both strategies can help you make informed decisions that align with your financial goals and risk tolerance.

Long-Term Investing

Pros:

- Compounding Returns:

- Long-term investments benefit from compound interest, where the returns on investments generate their own returns over time. This can significantly increase the value of your investment.

- Reduced Transaction Costs:

- With fewer trades, long-term investors incur lower transaction costs and fees compared to active short-term traders.

- Tax Advantages:

- Long-term capital gains (investments held for more than a year) are often taxed at a lower rate than short-term capital gains, which can result in significant tax savings.

- Less Stress:

- Long-term investing involves less day-to-day monitoring and decision-making, reducing the stress and emotional strain associated with frequent trading.

- Historical Performance:

- Historically, the stock market has trended upwards over the long term, despite short-term volatility. This makes long-term investing a reliable strategy for wealth accumulation.

Cons:

- Capital Commitment:

- Money invested for the long term is not readily accessible for other purposes, which can be a disadvantage if you need liquidity.

- Market Risk:

- Long-term investments are still subject to market risks and downturns. While the market generally recovers, there can be extended periods of poor performance.

- Patience Required:

- Long-term investing requires patience and discipline to stay invested through market fluctuations and avoid panic selling during downturns.

Short-Term Investing

Pros:

- Liquidity:

- Short-term investments provide greater liquidity, allowing you to access your funds more quickly if needed.

- Potential for Quick Profits:

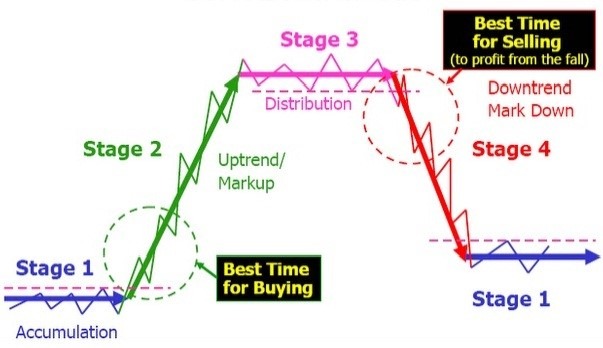

- Short-term trading can yield significant profits in a short period, especially if you can capitalize on market trends and price movements.

- Flexibility:

- Short-term investors can quickly adjust their strategies based on market conditions and new information, potentially minimizing losses.

- Diverse Opportunities:

- Short-term trading allows you to take advantage of various market opportunities, such as stock price fluctuations, earnings announcements, and economic data releases.

Cons:

- Higher Transaction Costs:

- Frequent trading results in higher transaction costs and fees, which can erode profits over time.

- Increased Tax Burden:

- Short-term capital gains are taxed at higher rates than long-term gains, reducing the net returns from successful trades.

- Greater Risk:

- Short-term trading involves higher risks, including market volatility and the potential for significant losses in a short period.

- Time-Consuming:

- Successful short-term trading requires constant monitoring of the market, extensive research, and quick decision-making, which can be time-consuming and stressful.

- Emotional Stress:

- The fast-paced nature of short-term trading can lead to emotional decision-making and increased stress, potentially resulting in poor investment choices.

Conclusion

Both long-term and short-term investing have their own set of advantages and disadvantages. Long-term investing is generally more suitable for those seeking steady growth, lower stress, and tax benefits, while short-term investing can appeal to those looking for liquidity, flexibility, and the potential for quick profits. Your choice of strategy should align with your financial goals, risk tolerance, and investment horizon.