Trading for Beginners: An absolute Guide

We aim to give absolute clarity on the most asked questions while testing the share markets:

- What should be the absolute return expectation?

- How much capital should I deploy?

- Selling vs. buying: which is better?

- Strategies that I can follow as a beginner.

Let’s begin:

- Return Expectations

Return percentages can differ based on capital and risk appetite. If you aim to earn 2-3% of your capital per month (24%-36% annually), you are ahead of many top-notch hedge funds across the country. Setting realistic expectations is crucial in maintaining a healthy trading mindset.

- Capital Deployment

- Option Buyer: Starting with a capital of 50K is decent, considering you may lose it soon.

- Option Seller: An initial capital of 5L is recommended, considering potential adjustments. You may also begin with 2L capital.

- Selling vs. Buying

- Buying: Preferred for beginners for testing the waters. Start with cash buying in liquid stocks, preferably in the top Nifty 50.

Progression Path:

- Stocks (Cash buying in liquid stocks)

- Stock Options

- Index Futures

- Stock Options (depending on market reading and strategy) *

* this Index future and stock options can be replaceable depending on your reading of market, in case you have perfected the direction you may prefer stock options first then futures (considering higher charges for futures and decay for options)

- Strategies for Beginners

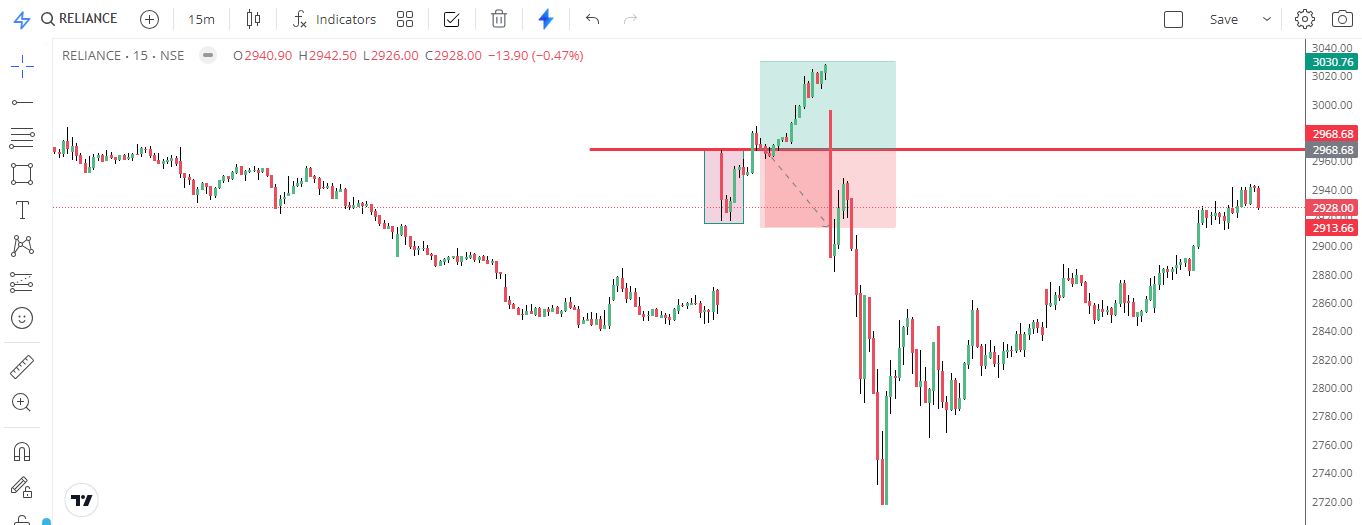

- a) 15-Minute Breakout Strategy

- Execution: Buy/sell 1 lot when a 15-minute candle breaks on the upside or downside.

- Risk/Reward: Aim for a 1:1

- Purpose: This strategy helps to know the market direction and improves trading psychology.

- Apply in Stock trading with low capital (preferably in cash)

Example Chart: 15-Minute Time Frame of Reliance Industries

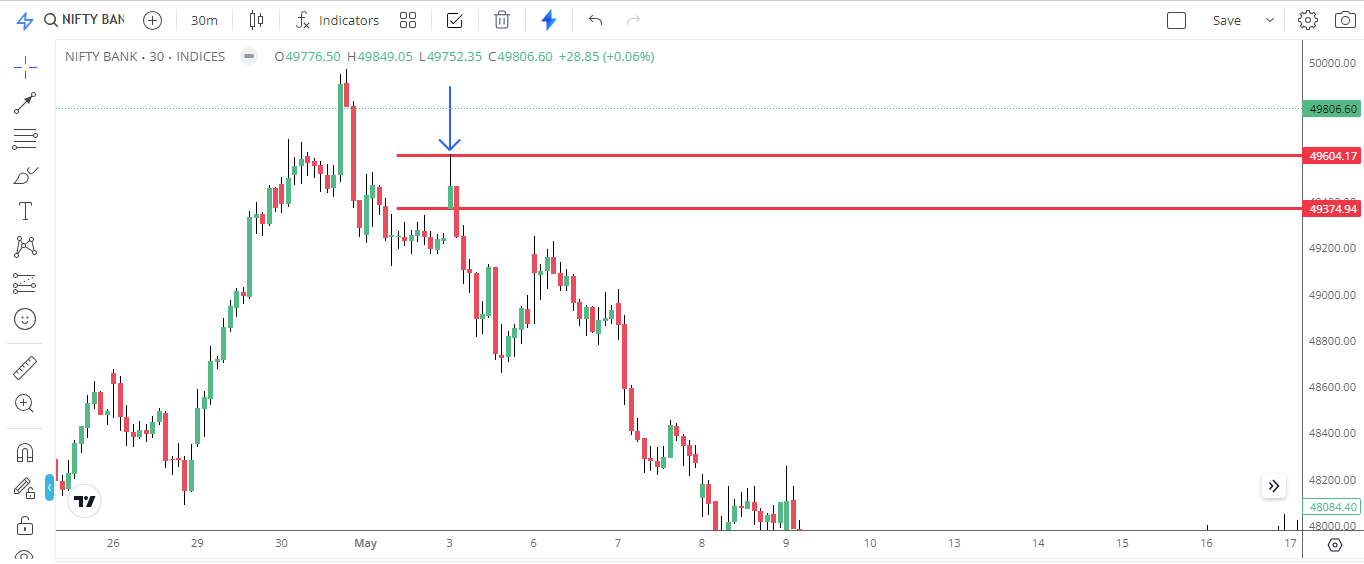

- b) 30:3 Strategy

- Execution:

- Mark the high and low on the morning 30-minute candle.

- Convert the chart to a 3-minute timeframe.

- When a 3-minute candle closes above/below the high/low(marked lines), take the trade for a 1:1 risk/reward ratio.

- Application: Often used in index trading. Consider selling an At-the-Money (ATM) option in bank nifty

- Example:

- Sell a 49300-call option of the weekly expiry series.

Example Charts:

- Bank Nifty 30-Minute Chart on 3rd May 2024

- Bank Nifty 3-Minute Chart on 3rd May 2024

Summary

As a beginner, focusing on learning and understanding market dynamics is essential. Start small, follow simple strategies, and gradually increase your capital and risk exposure as you gain experience and confidence. Remember, trading is a journey, not a sprint.

Disclaimer: This is just a recommendation. Do your due diligence before any bets.